These are the most common real estate questions that are asked in Thailand when it comes to buying or selling property. If your question is not listed here then call us now at +66-859105124 or email us [email protected] online.

Can a foreigner own a freehold condominium in their own name in Thailand?

One of the easiest ways for a foreign citizen to own a real estate asset in Thailand is to take advantage of the fact that Thai laws allow foreigners to own condominium freehold. A condominium is defined as “a building that can have its separate portions sold to individuals or groups for personal property ownership”

The area of a condominium building is divided in two distinct areas, the private area that is to say flat units that are represented by condominium units titles deeds which can be privately own and the common area that is to say the facilities, utilities, and the land on which the condominium is built. The Common Area shall become the property of the Juristic Condominium person.

To be eligible to purchase a condominium, a foreign buyer must be able to enter Thailand legally and present proof to the Land Department that the funds used for the purchase of the condominium have been remitted from overseas in foreign currency with that the bank will generally issue you a TT3 (Tor-Tor Sam) or a letter signed and stamped by the Bank and its official showing this proof. Without such proof, the Land Department will not permit the transfer of ownership to the foreign buyer.

The foreign currency must be brought and be exchanged in Thailand. Purchase of Thai Baht on the International market would not qualify in this regard. The money must either come from a bank account in the name of the foreign buyer; or be transferred to a bank account on the name of the foreign buyer. The name of the buyer must appear at one end of the transaction or the other. The minimum of foreign currency to be brought by a foreigner to be eligible to condominium freehold ownership must be at least equivalent to the purchasing price of the condominium. For proof purpose, it is better to make transfer of a minimum of US$ 10,000 per transfer.

What is a Foreign Exchange Transaction Form (FET) or (TT3)?

The form issued by a bank certifying the existence of a foreign exchange transaction or a TT3, this is required if you are purchasing a condominium in “foreign Quota” in a condominium project.

Debt Clearance Letter from the AOAO (Juristic Persons)

In addition to the TT3, you will also need to obtain a Debt Clearance letter from the Juristic persons of the condominium you are purchasing in. This provides the amount of foreign quota in a condominium to be cross checked with the Land office when you transfer and ensures that the condo is within the law of foreign quota ownership in the building and, that there are no outstanding debts of the previous owner owed on maintenance fees, or legal actions against the unit.

Can a foreigner secure a Mortgage Loan?

Normally non-resident foreigners are not allowed to apply for loan with Thai Banks.

However there are some sellers willing to finance their sale, and other private lenders who will fund a portion of the sales price to the buyer.

Each case varies and rates and terms vary, but most are reasonable if you deal with reputable companies and individuals.

Ensure you a have a Thai Lawyer* review the terms of the notes and mortgages as most will be in Thai and English, Thai langue will always prevail in Court or Arbitration if there is a dispute.

What are property transfer fees or closing costs on average for a purchase?

Normal rates are as follows:

Special Business Tax 3.3% (applicable in case of resale during the first 5 year of ownership)

Transfer Fees = 2% of the assessed value on property transfer and 1% of the rental value on 30 years for lease registration

This is for existing properties already with chanotes recorded in the land office

Who pays costs the purchase costs on a transaction?

The parties are free to negotiate who paid the costs at the time of the purchase. Except on New Developments being transferred for the first time.

In the case of a new development purchase the developer is required to pay most fees, the actual transfer fee of 2% is normally spilt 50/50.

This is the law, and many developers do not inform buyers of their rights, please consult a *Thai lawyer to review all purchase contracts on new developments

What is a Chanote” or “Nor Sor See”

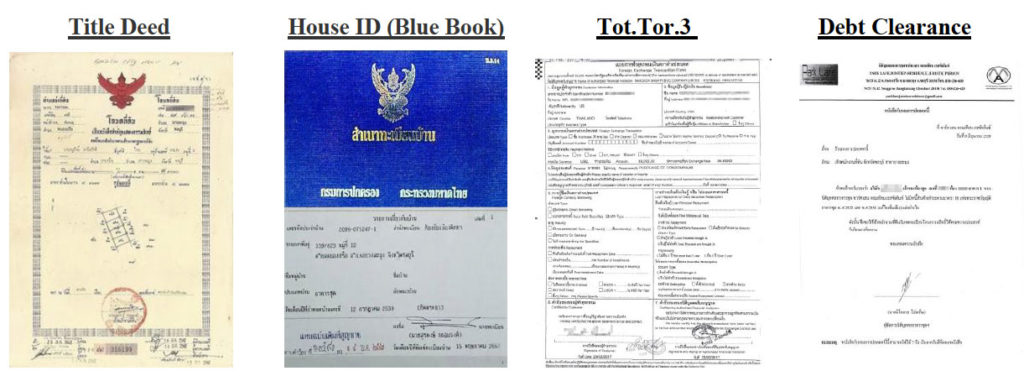

It’s a Freehold Title Deed that is based on a geometrical accurate survey of the land made by the Land Department which exact boundaries are marked by concrete plot markers. It contains a description and a map of the land, including the area, boundaries, and marking posts, and a history of all registered transactions concerning the land; grants to its owner full right of ownership on the land.

Currently “Chanotes” are available in Bangkok, provincial city, and the most developed areas of provinces. Progressively, “Chanotes” shall be available in all of Thailand. A “Chanote” title is printed on yellow paper of rectangular form and is recognizable by the red Garuda (emblem) on the top center of the title.

In addition to the Chanote every property should have a house registration book or “Blue Book” attached to the unit and should be given to the buyer along with the Chanote for review and when the transaction is completed of (transferred to the new owner)

How is land measured and how are prices expressed?

In Thailand, Land is measured in Rai, Ngan, and Wah.

1 Rai = 1600 Sqm or 4 Ngan

1 Ngan = 400 Sqm or 100 Square Wah

1 Square Wah = 4 Sqm

Typically condominium sizes are quoted in SQM, and includes all living area under roof and balcony on the Title Deed (Chanote)

Is there a property tax?

Yes, the property tax is currently 12.5% of a property yearly assessed rental value. Tax is not due if the individual owner live himself in the property.

Is there a sales tax in Thailand?

VAT Rate of 7%: VAT on Sale of goods or services rendered in Thailand and on Import of goods are currently at 7%. Note that actual VAT rate is 10%. This is one of the remaining measures that were adopted by the Government following the 1997 crisis. The 7% rate is renewed year by year by the Government

VAT Rate of 0%: the VAT rate is at 0% for the following transactions: Export of goods; provision of services performed in Thailand and used in a foreign country; provision of international transport services by aircraft or sea-going vessel; sale of goods and provision of services to the authorities or state enterprise under a foreign loan or assistance project; sale of goods and provision of services to the United Nations Organization; sale of goods and provision of services between one bonded warehouse and another.

VAT Exemption: are exempted from the VAT the sale of goods which is not an export, or provision of services under Section 81 (1) which includes sale of agricultural produce, animal and animal, feeds, fertilizer, chemical products for eradicating weeds, sale of newspaper, inland transport service, rental of immovable property. Are also exempted from the VAT the import of goods under Section 81 (2) such as sale of agricultural produce, animal and animal feeds, fertilizer, chemical products for eradicating weeds, sale of newspaper, etc. Finally are exempted from the VAT Small business where tax base does not exceed 1,800,000 Baht.

*Thai Lawyers are the only licensed and approved lawyers by the courts to represent a client. Foreign Lawyers are not, regardless of their legal status in their home country, however they may consult a client.

Sample of Documents to review and take to the land registration office on the day of transfer